Accounting Equation Sheet - From a legal standpoint, they are not separate. • the fundamental accounting equation is: Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Assets = liabilities + equity • this equation must always balance,. This equation will also be used to describe the effect of every economic transaction a business completes. It is important to recognize. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business.

From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Assets = liabilities + equity • this equation must always balance,. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. From a legal standpoint, they are not separate. It is important to recognize. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. This equation will also be used to describe the effect of every economic transaction a business completes. • the fundamental accounting equation is:

Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. • the fundamental accounting equation is: From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. This equation will also be used to describe the effect of every economic transaction a business completes. Assets = liabilities + equity • this equation must always balance,. It is important to recognize. From a legal standpoint, they are not separate.

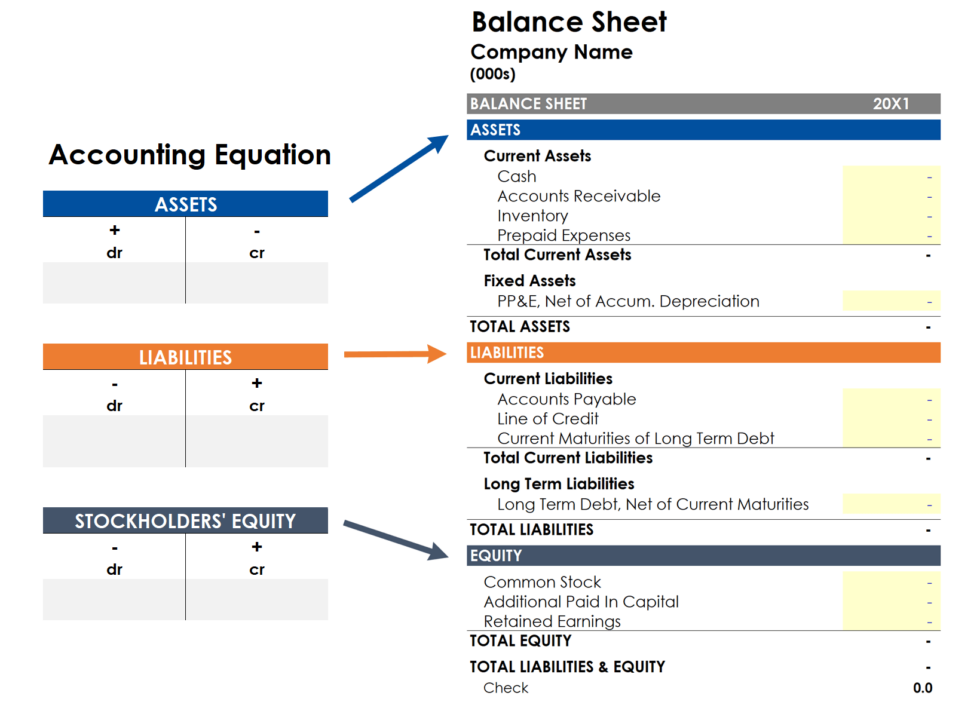

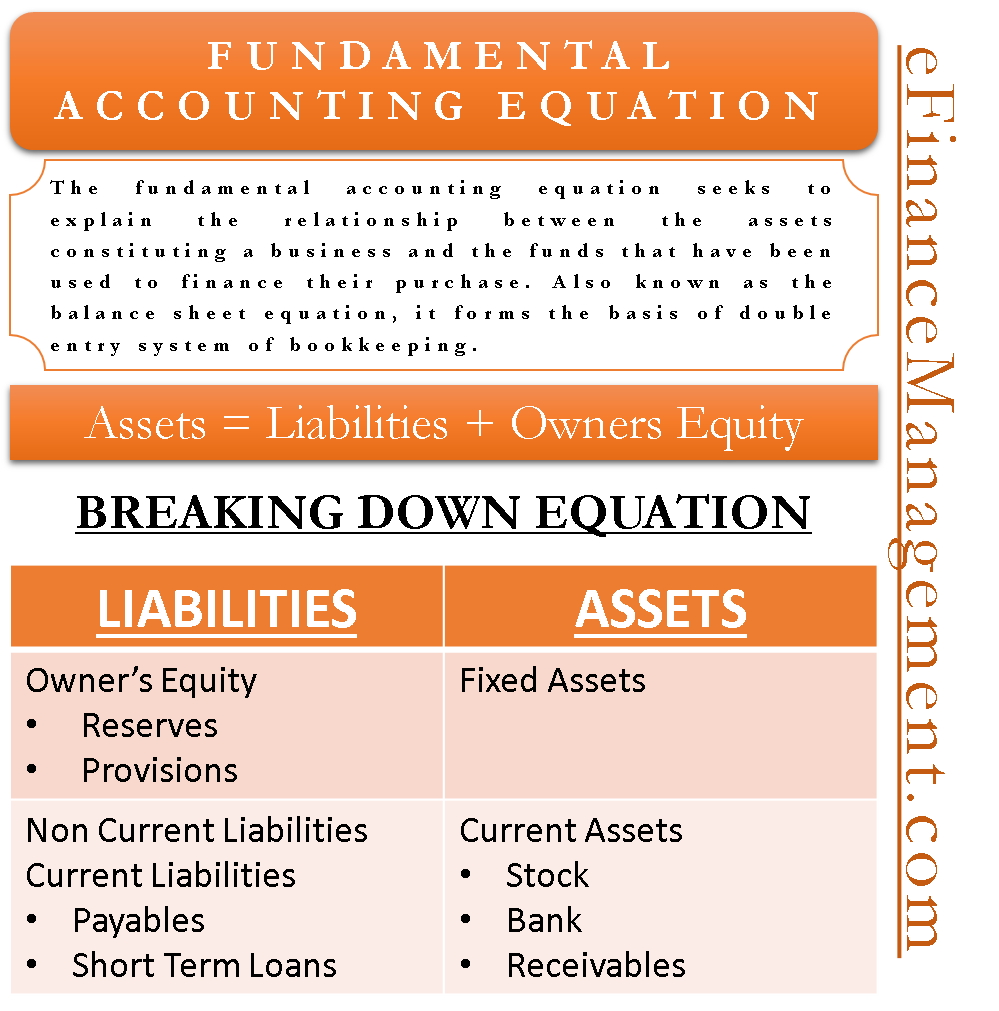

The Accounting Equation A Simple Model

Assets = liabilities + equity • this equation must always balance,. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. This equation will also be used to describe the effect of every economic transaction a business completes. From a legal standpoint, they are not separate. It is important to recognize.

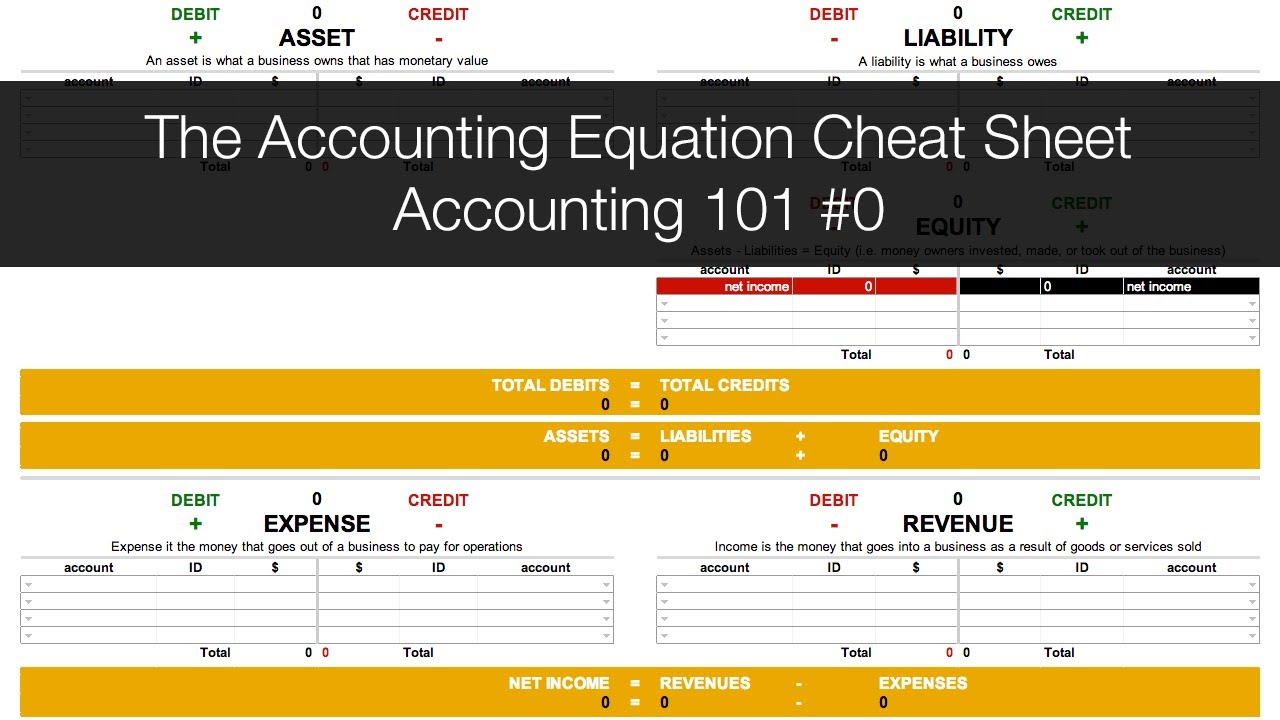

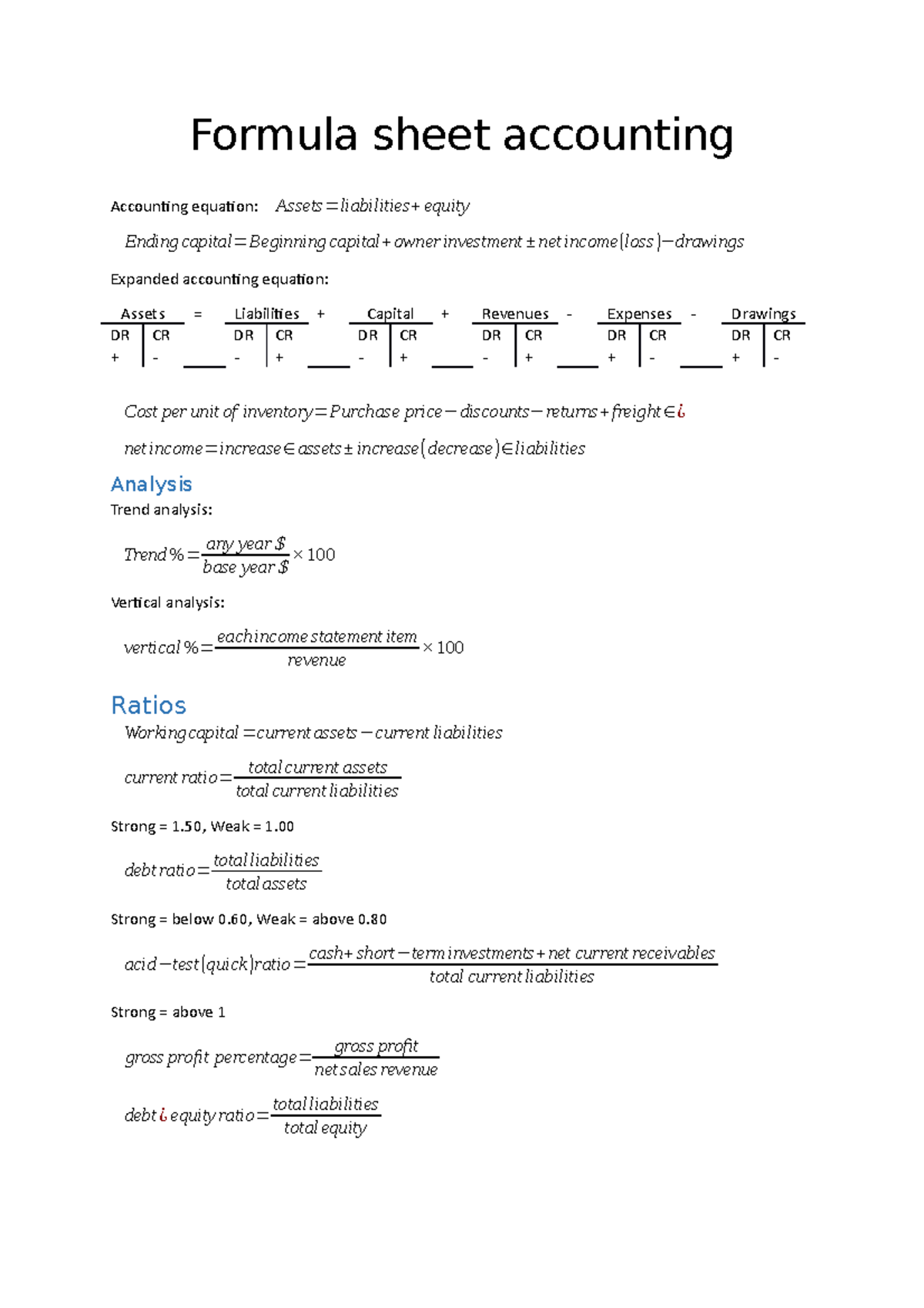

Accounting Equation Cheat Sheet PDF

Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. Assets = liabilities + equity • this equation must always balance,. It is important to recognize. • the fundamental accounting equation is:

Introducing the Accounting Equation Cheat Sheet Accounting 101 0

It is important to recognize. • the fundamental accounting equation is: This equation will also be used to describe the effect of every economic transaction a business completes. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. From an accounting viewpoint, it is a business entity separate from the affairs.

Accounting Equation Cheat Sheet

It is important to recognize. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. From a legal standpoint, they are not separate. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. Assets = liabilities + equity • this equation must always balance,.

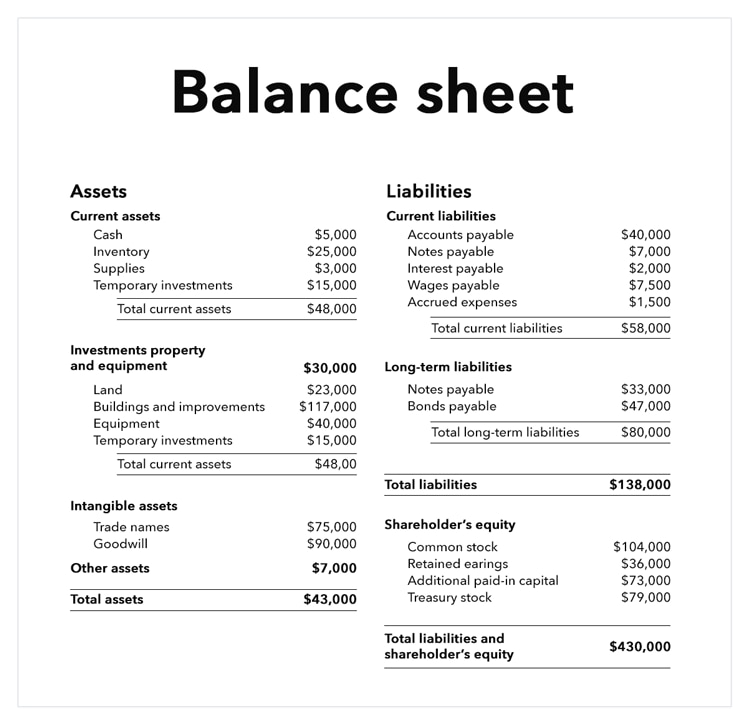

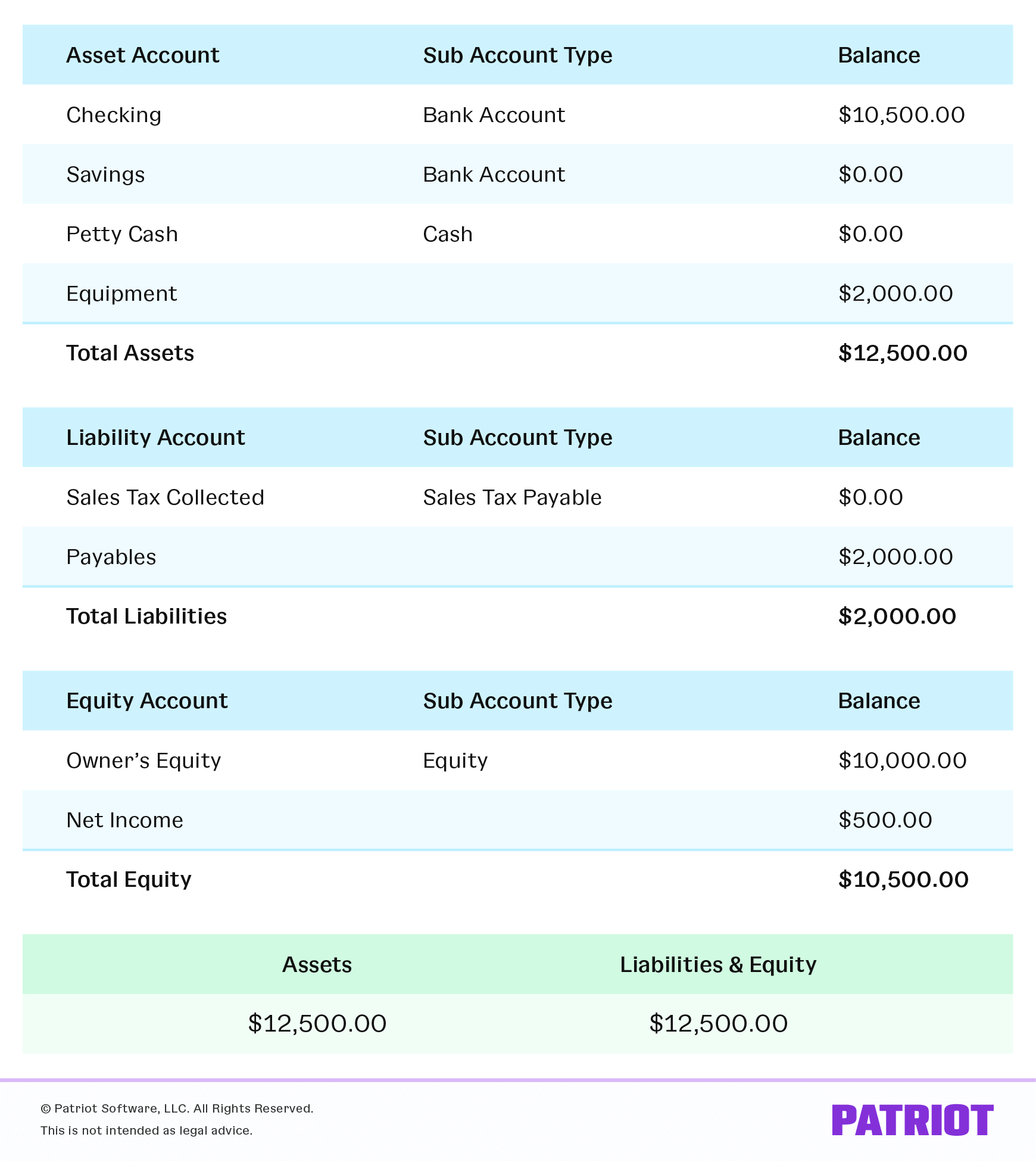

8 accounting equations every business owner should know Article

Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. • the fundamental accounting equation is: From an accounting viewpoint, it is a business entity separate from the affairs of the owner. This equation will also be used to describe the effect of every economic transaction a business completes. Assets = liabilities + equity.

Formula Sheet Accounting Formula Sheet Accounting Acc vrogue.co

From a legal standpoint, they are not separate. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. • the fundamental accounting equation is: Assets = liabilities + equity • this equation must always balance,. It is important to recognize.

What Is the Accounting Equation? Examples & Balance Sheet

• the fundamental accounting equation is: From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Assets = liabilities + equity • this equation must always balance,. Learn the fundamentals of the accounting equation and how it applies.

The Accounting Equation

This equation will also be used to describe the effect of every economic transaction a business completes. From a legal standpoint, they are not separate. From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Assets = liabilities + equity • this equation must always balance,. • the fundamental accounting equation is:

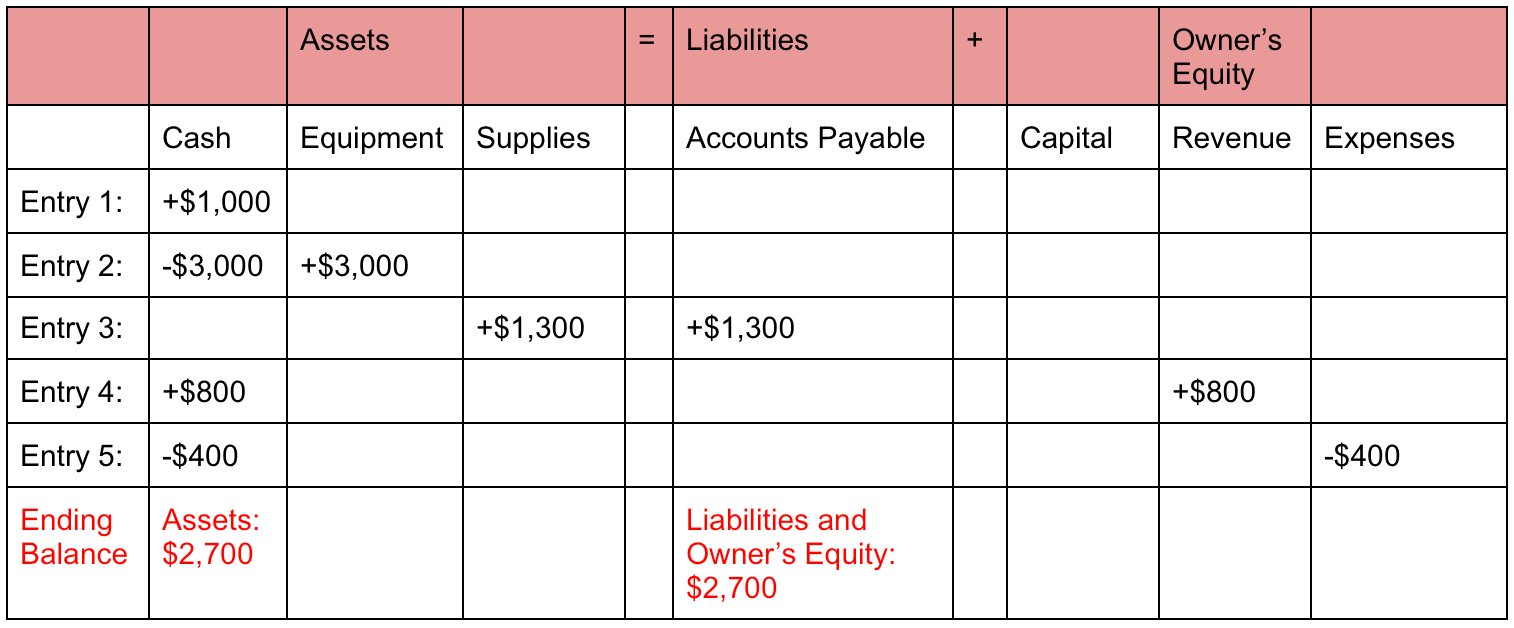

Fundamental Accounting Equation Elements, Example with Transactions

From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. This equation will also be used to describe the.

Accounting Equation Cheat Sheet

From a legal standpoint, they are not separate. • the fundamental accounting equation is: Revenue recognition recognize (book into accounting record) revenue when it is earned and realizable expense recognition. Assets = liabilities + equity • this equation must always balance,. This equation will also be used to describe the effect of every economic transaction a business completes.

Revenue Recognition Recognize (Book Into Accounting Record) Revenue When It Is Earned And Realizable Expense Recognition.

Learn the fundamentals of the accounting equation and how it applies to various transactions in a sole trade business. • the fundamental accounting equation is: It is important to recognize. From a legal standpoint, they are not separate.

This Equation Will Also Be Used To Describe The Effect Of Every Economic Transaction A Business Completes.

From an accounting viewpoint, it is a business entity separate from the affairs of the owner. Assets = liabilities + equity • this equation must always balance,.