Cash On Balance Sheet - Monitoring cash balances over time is a way of measuring business health and solvency. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Cash includes currency and demand deposits, while cash equivalents are short. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Cash is reported in the current assets portion of the balance sheet. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of.

Cash is reported in the current assets portion of the balance sheet. Cash includes currency and demand deposits, while cash equivalents are short. The most liquid of all assets, cash, appears on the first line of the balance sheet. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of. Monitoring cash balances over time is a way of measuring business health and solvency.

Monitoring cash balances over time is a way of measuring business health and solvency. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash includes currency and demand deposits, while cash equivalents are short. Cash is reported in the current assets portion of the balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of.

Excel Statement And Balance Sheet Template

Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of. Monitoring cash balances over time is a way of measuring.

How To Make A Balance Sheet And Statement In Excel at Frankie

Monitoring cash balances over time is a way of measuring business health and solvency. Cash is reported in the current assets portion of the balance sheet. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. The most liquid of all assets, cash, appears on the first line of the balance sheet. Assets are anything the.

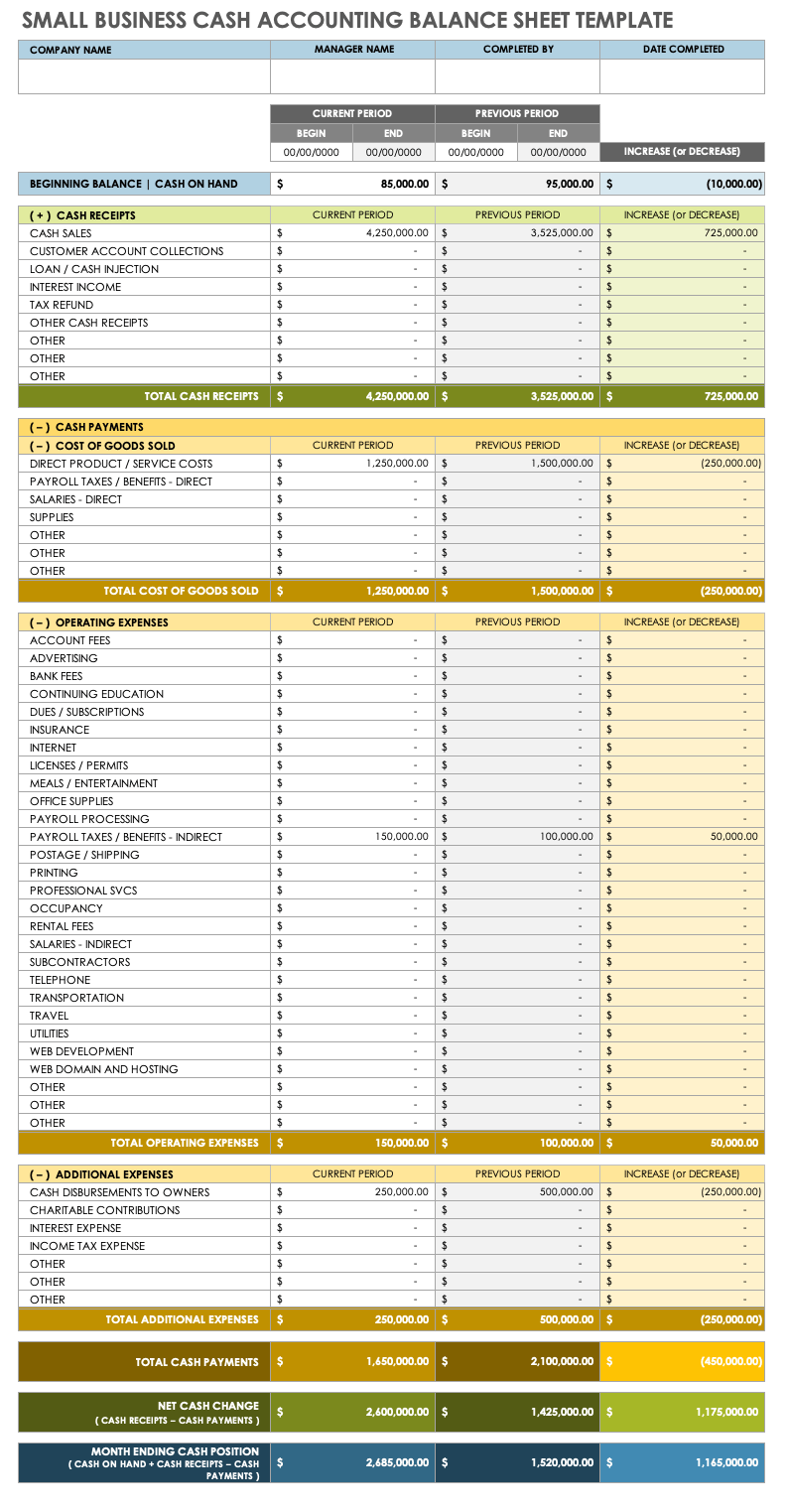

Small Business Balance Sheet Templates Smartsheet

Cash includes currency and demand deposits, while cash equivalents are short. Monitoring cash balances over time is a way of measuring business health and solvency. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Assets are anything the company.

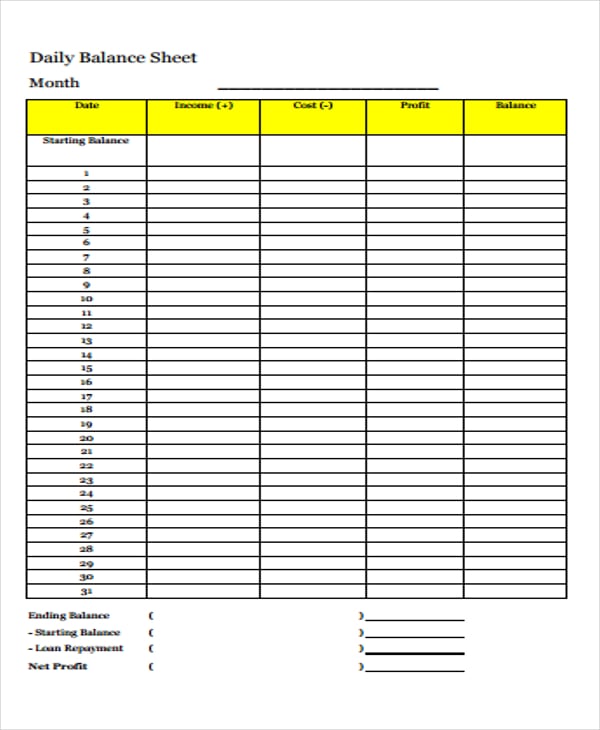

Account Balance Spreadsheet Template with 38 Free Balance Sheet

The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Monitoring cash balances over time is a way of measuring business health and solvency. Cash includes currency and demand deposits, while cash equivalents are short. Cash and cash equivalents mainly.

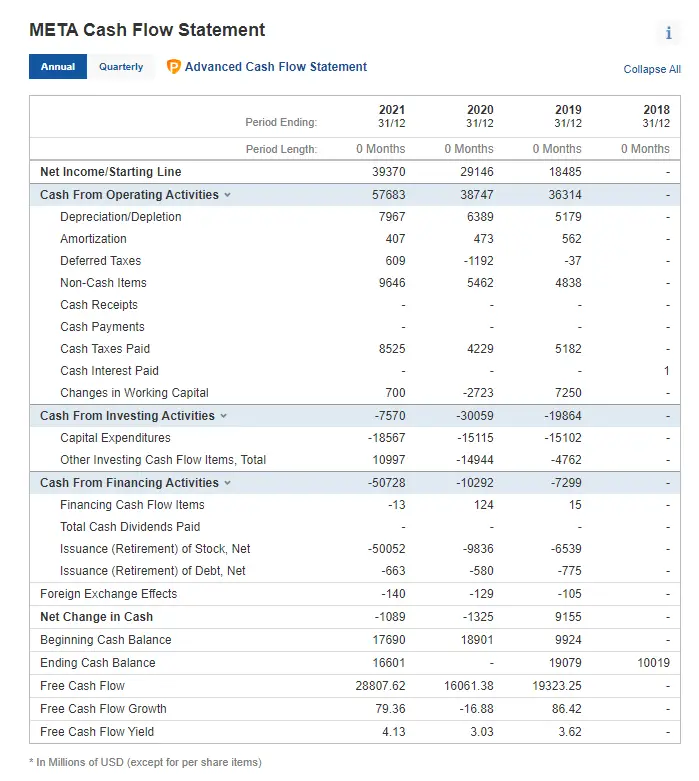

What Is a Financial Statement? Detailed Overview of Main Statements

Monitoring cash balances over time is a way of measuring business health and solvency. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Cash is reported in the current assets portion of the balance sheet. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Monitoring cash balances over time is a way of measuring business health.

How To Make Balance Sheet Statement And Cash Flow at Anna Kiefer

The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of. Assets are anything the company owns that holds.

Cashier Balance Sheet Template Excel Templates

Monitoring cash balances over time is a way of measuring business health and solvency. Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash includes currency and demand deposits, while cash.

Cash Balance Sheet Template

Monitoring cash balances over time is a way of measuring business health and solvency. Cash includes currency and demand deposits, while cash equivalents are short. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form.

Difference Between Balance Sheet And Cash Flow Statement at Justin

Monitoring cash balances over time is a way of measuring business health and solvency. Cash includes currency and demand deposits, while cash equivalents are short. Cash is reported in the current assets portion of the balance sheet. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents (cce) are the.

Cash Includes Currency And Demand Deposits, While Cash Equivalents Are Short.

Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Cash and cash equivalents (cce) are the liquid assets on a company's balance sheet. Monitoring cash balances over time is a way of measuring business health and solvency. The most liquid of all assets, cash, appears on the first line of the balance sheet.

Cash And Cash Equivalents Mainly Refer To The Line Items On The Balance Sheet That Represent The Underlying Value Of The Company’s Assets That Are In The Form Of Cash Or Any Other Liquid Form Of.

Cash is reported in the current assets portion of the balance sheet.