What Is Equity Capital In Balance Sheet - Equity is one of the main components present on the. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity capital represents the funds a company raises by issuing shares to investors. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Unlike debt, equity does not require repayment. Key different between equity and capital. Capital = 80,000 + 20,000. This represents the core funding of a business,. Instead, shareholders gain ownership stakes and.

Instead, shareholders gain ownership stakes and. Capital = 80,000 + 20,000. Equity is one of the main components present on the. Unlike debt, equity does not require repayment. Equity capital represents the funds a company raises by issuing shares to investors. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. This represents the core funding of a business,. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Key different between equity and capital.

This represents the core funding of a business,. Equity is one of the main components present on the. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Capital = 80,000 + 20,000. Instead, shareholders gain ownership stakes and. Key different between equity and capital. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital represents the funds a company raises by issuing shares to investors. Unlike debt, equity does not require repayment.

Owners’ Equity, Stockholders' Equity, Shareholders' Equity Business

Capital = 80,000 + 20,000. Key different between equity and capital. Unlike debt, equity does not require repayment. Equity capital represents the funds a company raises by issuing shares to investors. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company.

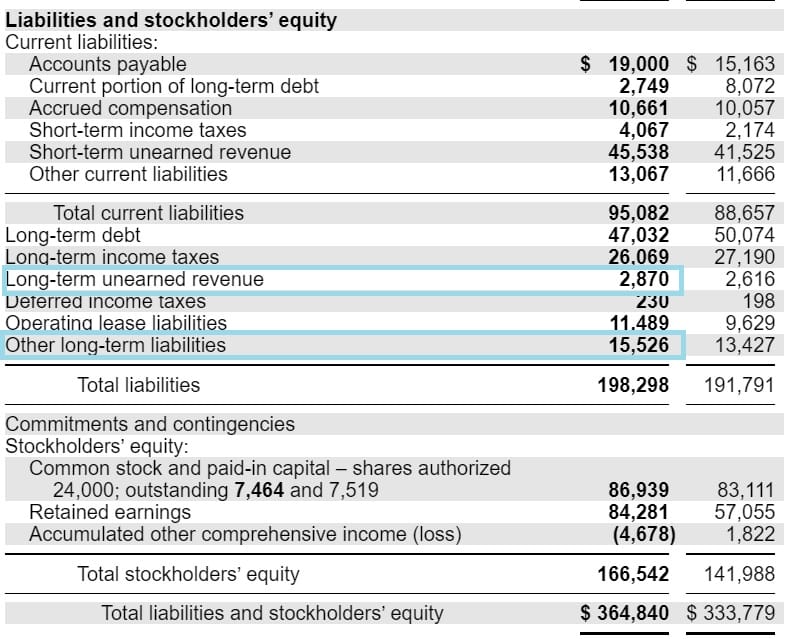

Balance Sheet Key Indicators of Business Success

Instead, shareholders gain ownership stakes and. Equity capital represents the funds a company raises by issuing shares to investors. Key different between equity and capital. Capital = 80,000 + 20,000. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock.

Balance Sheet Definition Formula & Examples

Equity is one of the main components present on the. This represents the core funding of a business,. Capital = 80,000 + 20,000. Unlike debt, equity does not require repayment. Equity capital represents the funds a company raises by issuing shares to investors.

Equity Method of Accounting Excel, Video, and Full Examples

Instead, shareholders gain ownership stakes and. Equity capital represents the funds a company raises by issuing shares to investors. This represents the core funding of a business,. Capital = 80,000 + 20,000. Key different between equity and capital.

How balance sheet structure content reveal financial position Artofit

Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. This represents the core funding of a business,. Equity is one of the main components present on the. Capital = 80,000 + 20,000. Equity capital represents the funds a company raises by issuing shares to investors.

The Balance Sheet

Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Unlike debt, equity does not require repayment. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital represents the funds a company raises by.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBS

Unlike debt, equity does not require repayment. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Instead, shareholders gain ownership stakes and. This represents the core funding of a business,. Key different between equity and capital.

Invested Capital Formula The Exact Balance Sheet Line Items to Use

Capital = 80,000 + 20,000. Instead, shareholders gain ownership stakes and. Equity is one of the main components present on the. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Unlike debt, equity does not require repayment.

How to Read a Balance Sheet (Free Download) Poindexter Blog

This represents the core funding of a business,. Equity capital is funds paid into a business by investors in exchange for common stock or preferred stock. Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Capital = 80,000 + 20,000. Instead, shareholders gain.

Equity Capital Is Funds Paid Into A Business By Investors In Exchange For Common Stock Or Preferred Stock.

Equity capital refers to the capital collected by a company from its owners and other shareholders in exchange for a portion of ownership in the company. Equity is one of the main components present on the. Equity capital represents the funds a company raises by issuing shares to investors. Instead, shareholders gain ownership stakes and.

Unlike Debt, Equity Does Not Require Repayment.

This represents the core funding of a business,. Capital = 80,000 + 20,000. Key different between equity and capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)