What Is Goodwill In A Balance Sheet - It arises when one company acquires. Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and.

It arises when one company acquires. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is an intangible asset representing the excess value of a company above its net asset value.

Goodwill is an intangible asset representing the excess value of a company above its net asset value. It arises when one company acquires. Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and.

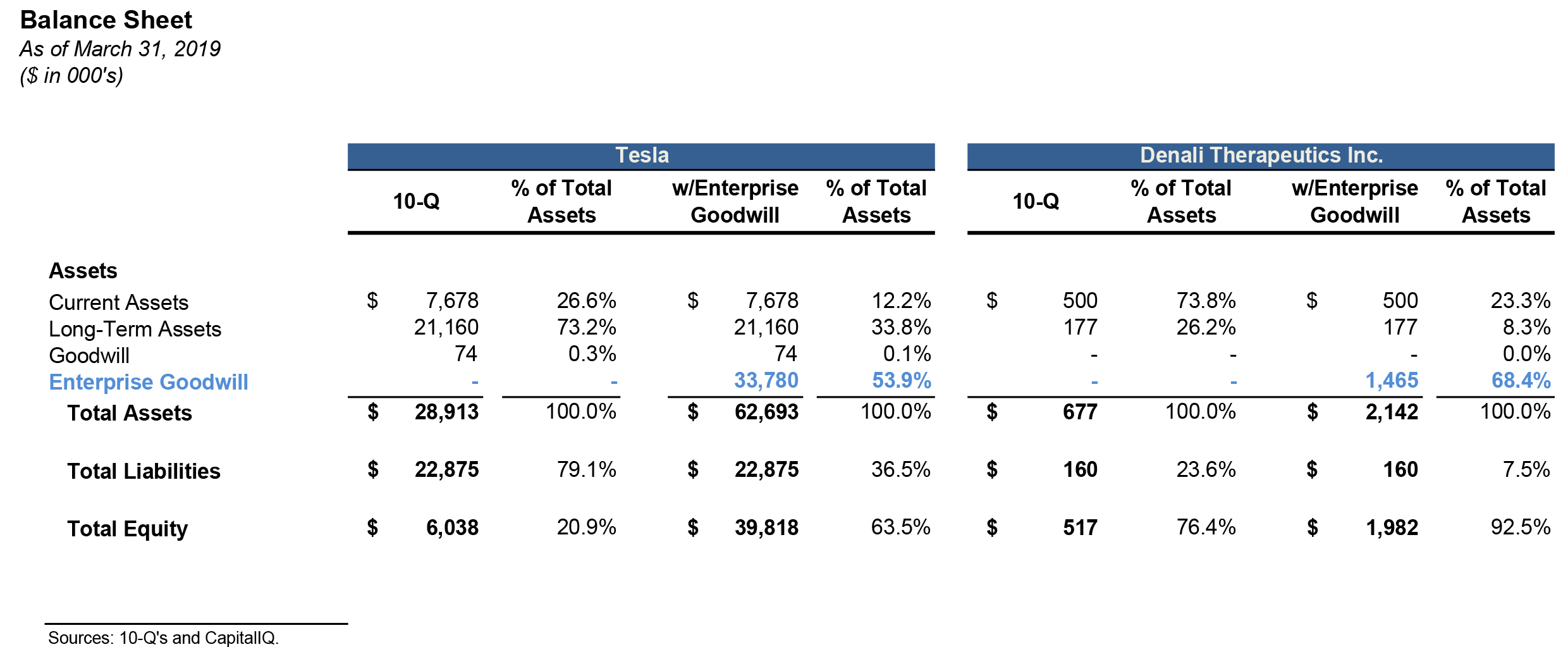

Accounting Goodwill Analyzing a Balance Sheet Investing Post

It arises when one company acquires. Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. Goodwill is an intangible asset that features prominently on a.

Maynard Solutions Ch15 Goodwill (Accounting) Balance Sheet

Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when one company acquires. Goodwill is an intangible asset that features prominently on a.

PPT Northrop Grumman Corporation PowerPoint Presentation, free

Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when one company acquires. Goodwill is an intangible asset that features prominently on a.

Getting behind a balance sheet Investors' Chronicle

Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when.

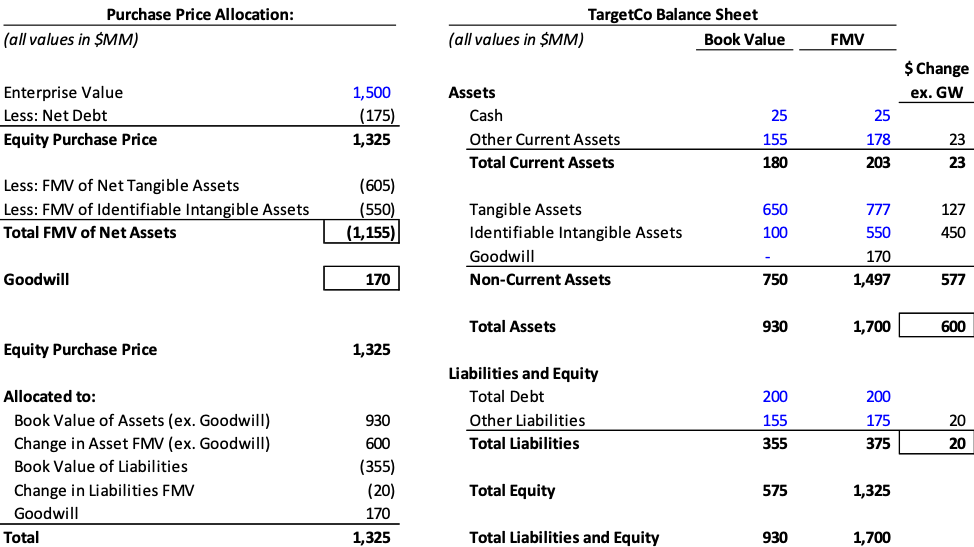

Goodwill in Finance Definition, Calculation, Formula

Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when one company acquires. Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is an intangible asset that features prominently on a.

Accounting for goodwill ACCA Global

Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is an intangible asset that features prominently on a company’s balance sheet. It arises when one company acquires. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all.

Redefining Goodwill To Save Balance Sheet Sorbus Advisors LLC

Goodwill is an intangible asset that features prominently on a company’s balance sheet. It arises when one company acquires. Goodwill is an intangible asset representing the excess value of a company above its net asset value. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all.

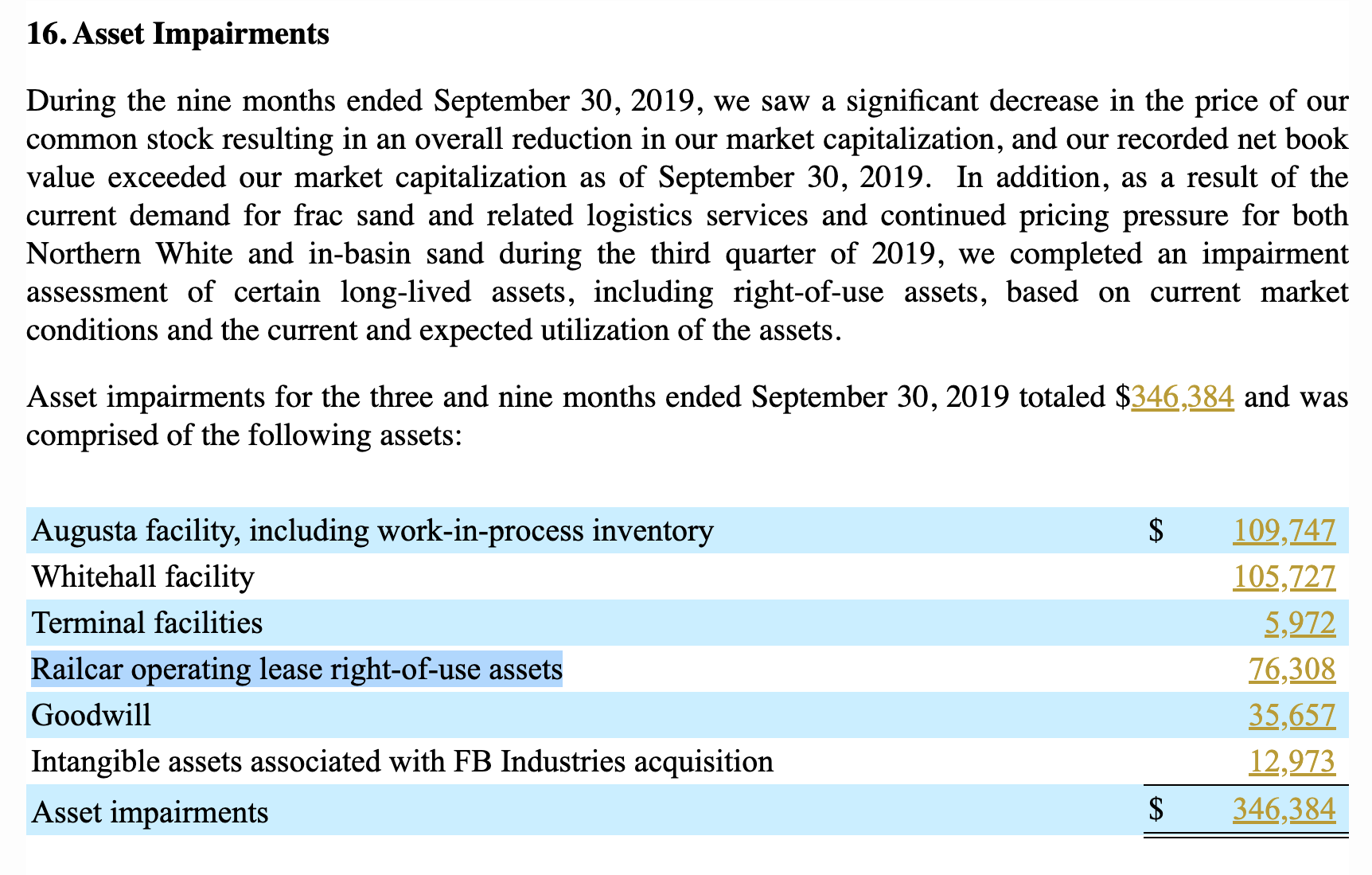

Fabulous Goodwill Footnote Disclosure Example Trial Balance Sheet Template

Goodwill is an intangible asset representing the excess value of a company above its net asset value. It arises when one company acquires. Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all.

Goodwill Accounting

Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when one company acquires. Goodwill is an intangible asset representing the excess value of a company above its.

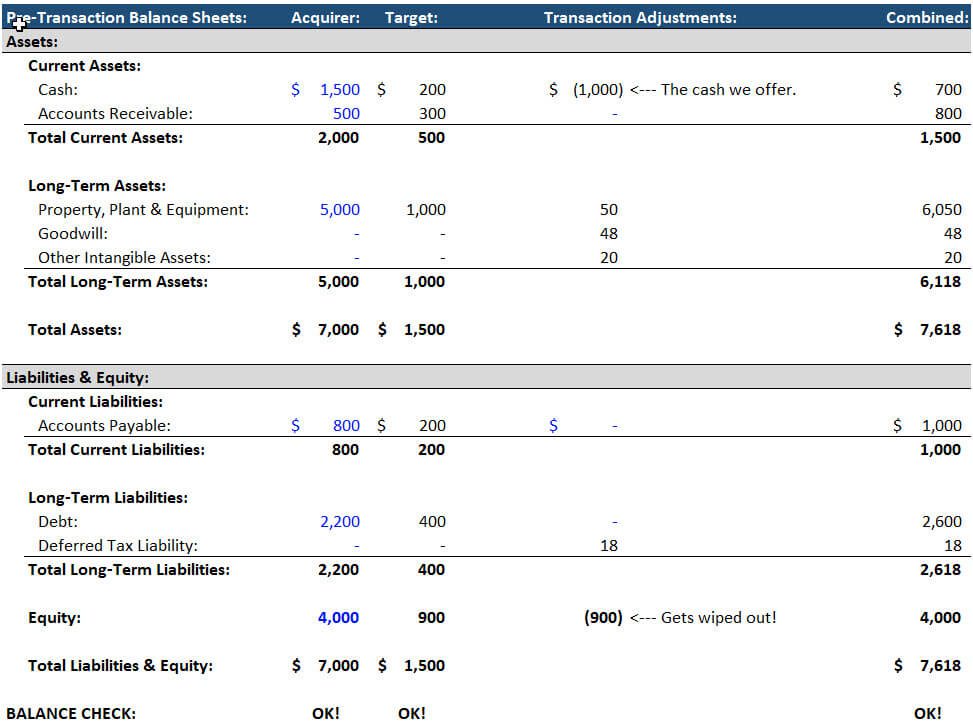

How to Calculate Goodwill Video Tutorial, Examples, and Excel Files

It arises when one company acquires. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is an intangible asset representing the excess value of a company above its.

Goodwill Is An Intangible Asset Representing The Excess Value Of A Company Above Its Net Asset Value.

Goodwill is an intangible asset that features prominently on a company’s balance sheet. Goodwill is defined as the part of the sales price that is greater than the sum of the total fair market value of all assets acquired and. It arises when one company acquires.